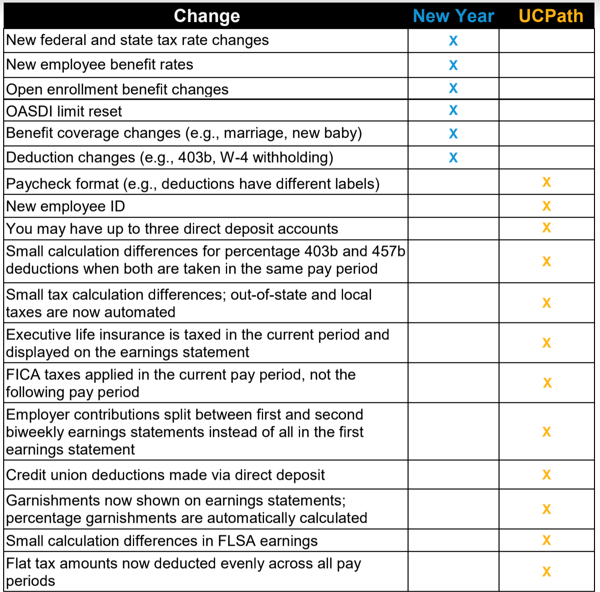

January 2020 Pay Differences

New Year Changes: These changes typically occur at the start of each year for some employees. They are not a result of UCPath implementation

- New federal and state tax rate changes

- New employee benefit rates

- Open Enrollment benefit changes

- OASDI limit reset

- Benefit coverage changes (e.g. marriage, new baby)

- Deduction changes (e.g. 403b, W-4 withholding)

UCPath Changes: These are changes you may notice as a result of UCPath implementation. All employees will see some UCPath changes on the first earning statement in January. However, other changes only apply in certain payroll deductions.

In some cases, amounts may be slightly different because UCPath uses industry-standard, automated calculations for deductions and withholdings, making them consistent across all UC locations.

With UCPath, employees will be paid on their current pay schedule (i.e. biweekly or monthly)

If you have questions about your UCPath earnings statement, please contact the UCSC Payroll office at payhelp@ucsc.edu

There is a related article from the UC Office of the President with the New Year's Paycheck Checklist.